Trump Declares 'War with the World' as Explosive Tariffs Crash Global Markets and Rattle World Economies

Global financial markets are in turmoil following the implementation of a sweeping wave of new US tariffs under President Donald Trump’s latest protectionist trade policy.

Global financial markets are in turmoil following the implementation of a sweeping wave of new US tariffs under President Donald Trump’s latest protectionist trade policy. Declaring what he called a "war with the world," Trump’s aggressive economic measures came into full effect over the weekend, sparking international backlash, investor panic, and fears of a worldwide recession.

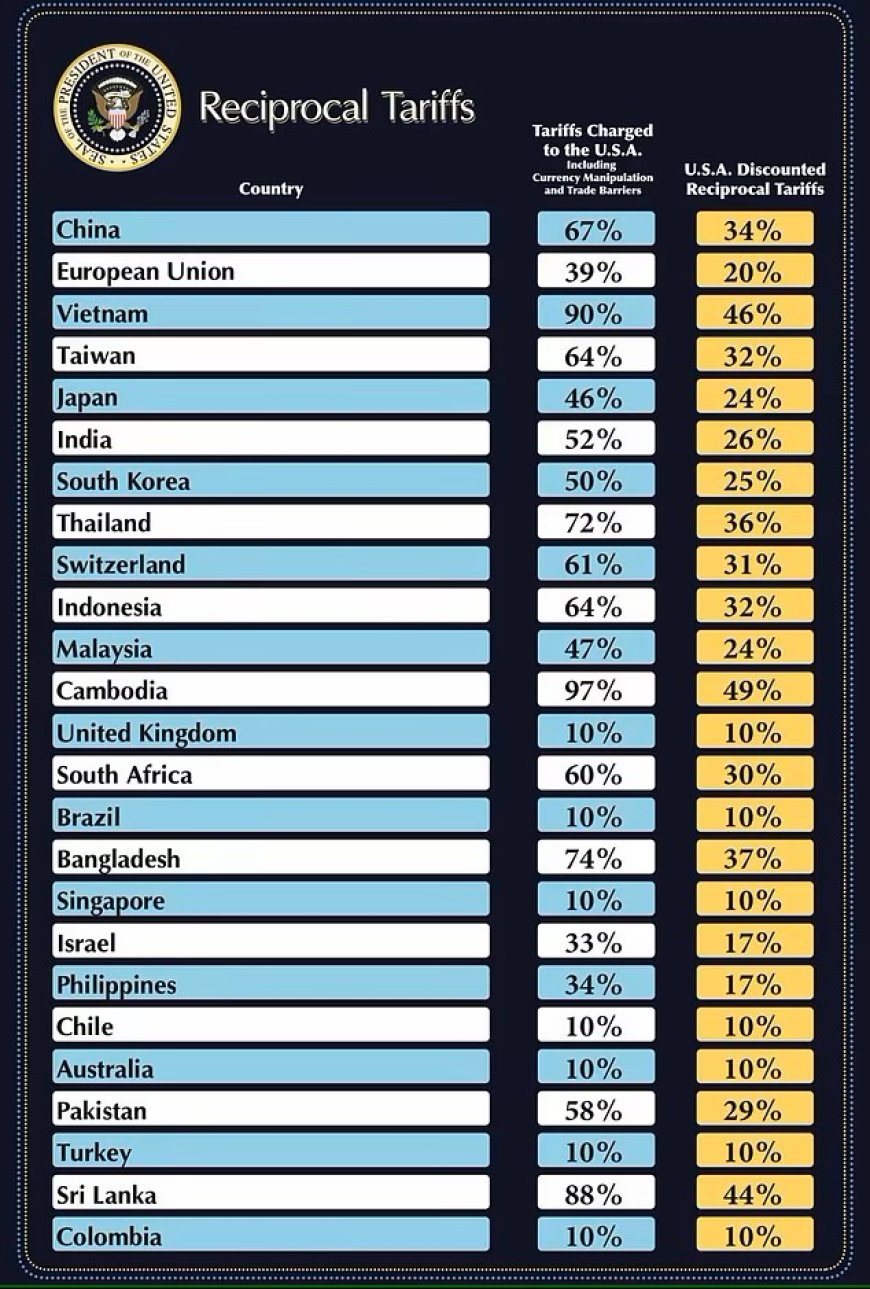

The most controversial of the new tariffs is a staggering 104% import tax on Chinese goods, aimed at reducing the US trade deficit and reviving domestic manufacturing. In total, more than 60 countries have been targeted by the US with new levies, including China, the EU, Japan, Thailand, South Africa, Vietnam, Cambodia, and Taiwan.

Markets around the globe responded sharply. In Asia, Japan’s Nikkei 225 index fell as much as 5% intraday, closing 3.9% lower at 31,714. Hong Kong’s Hang Seng dropped 1.8%, South Korea’s Kospi declined 1.9%, and Australia’s S&P/ASX 200 lost 1.8%. New Zealand stocks also closed lower, while China’s Shanghai Composite remained flat at 3,141, signaling nervous uncertainty.

On Wall Street, the volatility was just as severe. The S&P 500 dropped 1.6%, erasing a previous 4.1% rally. Since the announcement of the tariffs last week, the S&P 500 has shed nearly $6 trillion in value, marking the worst four-day plunge in the index’s history. It now teeters just 1% away from entering a bear market. The Dow Jones Industrial Average fell 0.8%, and the Nasdaq dropped 2.1%.

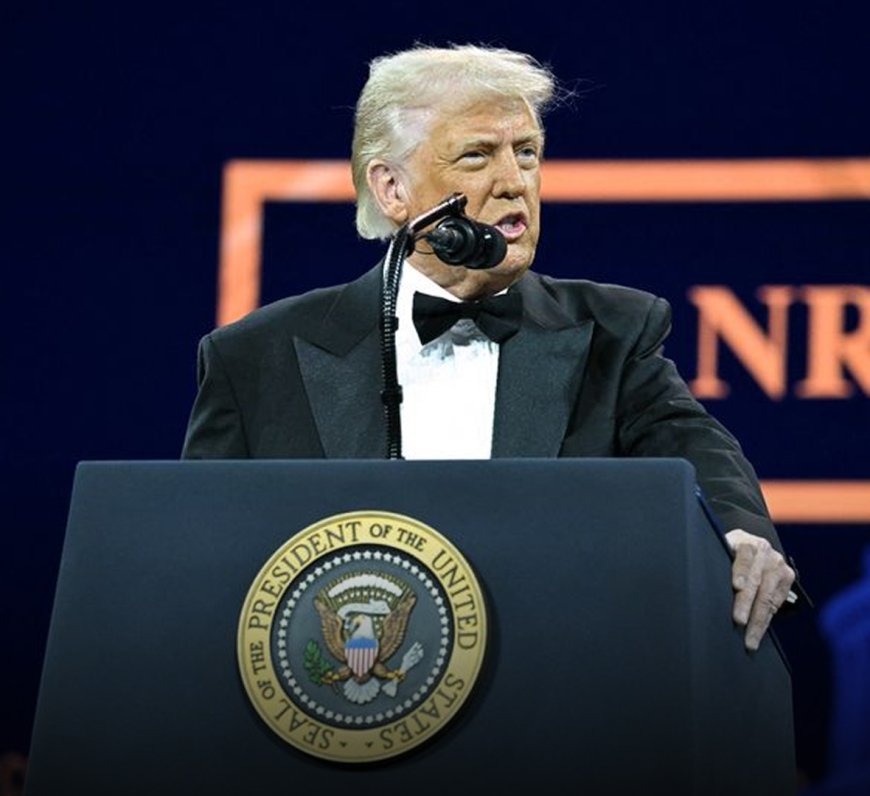

President Trump defended his actions in a speech to Republican lawmakers, stating:

"They ripped us off left and right. But now it's our turn to do the ripping. The war with the world is not a war at all—they’re coming here to negotiate. Japan is sending their toughest negotiators right now."

The US also imposed a 10% baseline tariff on most imports globally, with a 25% import tax on foreign cars, and newly proposed tariffs on pharmaceuticals expected soon. The administration says these moves are essential to reduce the US trade deficit and curb unfair foreign trade practices.

Beijing, in response, warned that China would “fight to the end” and implement countermeasures. This deepening economic standoff threatens to further strain US-China relations and impact global supply chains, which are already heavily interconnected.

In Europe, the UK responded cautiously. While countries like the EU immediately retaliated with their own import taxes, Britain held off, instead seeking a diplomatic solution. Chancellor Rachel Reeves emphasized a renewed push to accelerate trade deals globally and strengthen UK businesses.

“We are creating the best possible conditions for British business in a changing world,” Reeves stated. “This includes forging stronger economic ties with India and the EU, and exploring pathways for an agreement with the US.”

UK Prime Minister Sir Keir Starmer stressed the importance of negotiation over retaliation. He reiterated that all options remain on the table but expressed a preference for a more measured approach.

“We shouldn't jump in with both feet,” Starmer said. “Let’s focus on protecting British interests through smart diplomacy.”

The UK has conducted more than a dozen rounds of trade talks with India since 2022, but key disagreements over visa rules and access for British service firms remain unresolved.

Meanwhile, Starmer made it clear that the NHS will not be up for negotiation in any trade deal with the US, and insisted that the UK’s digital tax on big tech firms will stay, despite speculation it might be dropped to ease trade tensions.

Health Minister Stephen Kinnock described the current climate as “deeply turbulent” and said the UK must strengthen its ties with Brussels, develop a strong industrial strategy, and pursue a comprehensive agreement with the US to weather the storm.

As the world grapples with a new era of aggressive economic nationalism, Trump’s tariffs signal not just a shift in trade policy—but a seismic transformation in the global economic order.

What's Your Reaction?